The Best Strategy To Use For Offshore Wealth Management

Table of ContentsThe smart Trick of Offshore Wealth Management That Nobody is DiscussingNot known Incorrect Statements About Offshore Wealth Management The Offshore Wealth Management DiariesThe 2-Minute Rule for Offshore Wealth ManagementAbout Offshore Wealth Management

Offshore investments are frequently an attractive solution where a moms and dad has provided capital to a minor, or for those that can anticipate their marginal rate of tax obligation to fall. They additionally offer an advantage to financiers entitled to an age-related allowance, or expatriates that are spending while non-resident. Furthermore, overseas solutions might be suitable for financiers wishing to spend on a regular basis or as a one-off round figure into an array of possession courses and also money.They can offer you with the alternative of a regular earnings and also assist you to decrease your personal liability to Earnings and Resources Gains Tax Obligation. The worth of an investment with St. offshore wealth management. James's Location will be directly connected to the efficiency of the funds you pick as well as the worth can for that reason go down in addition to up.

The levels as well as bases of tax, and remedies for taxes, can change any time. The value of any type of tax obligation relief depends on individual scenarios.

The 9-Second Trick For Offshore Wealth Management

Lots of financiers use traditional investments like an actual estate and banking products, at repaired rates. From the long-term investment point of view, it can be much better to spend in funding holders whose efficiency is always extra appealing.

Depends on are outstanding financial investment lorries to secure possessions, and they have the capability to hold a vast variety of possession courses, including building, shares as well as art or antiques - offshore wealth management. They additionally permit effective circulation of assets to beneficiaries. An offshore trust that is managed in a protected territory permits effective wealth creation, tax-efficient monitoring as well as succession planning.

Some Known Details About Offshore Wealth Management

Clients who are afraid that their properties might be frozen or taken in case of prospective political chaos sight overseas financial as an eye-catching, safe way to shield their assets. Multiple overseas accounts water down the political threat to their wide range and also minimize the threat of them having their assets iced up or taken in an economic dilemma.

Nonetheless, wilful non-declaration of the holdings is not. US citizens are called for to proclaim possessions worth over US$ 10,000 in overseas accounts. With enhanced tax openness and tightening up of worldwide laws, it has ended up being harder for individuals to open up overseas accounts. The international suppression on tax obligation evasion has actually made offshore much less attractive and Switzerland, in specific, has actually seen a decrease in the number Bonuses of overseas accounts being opened.

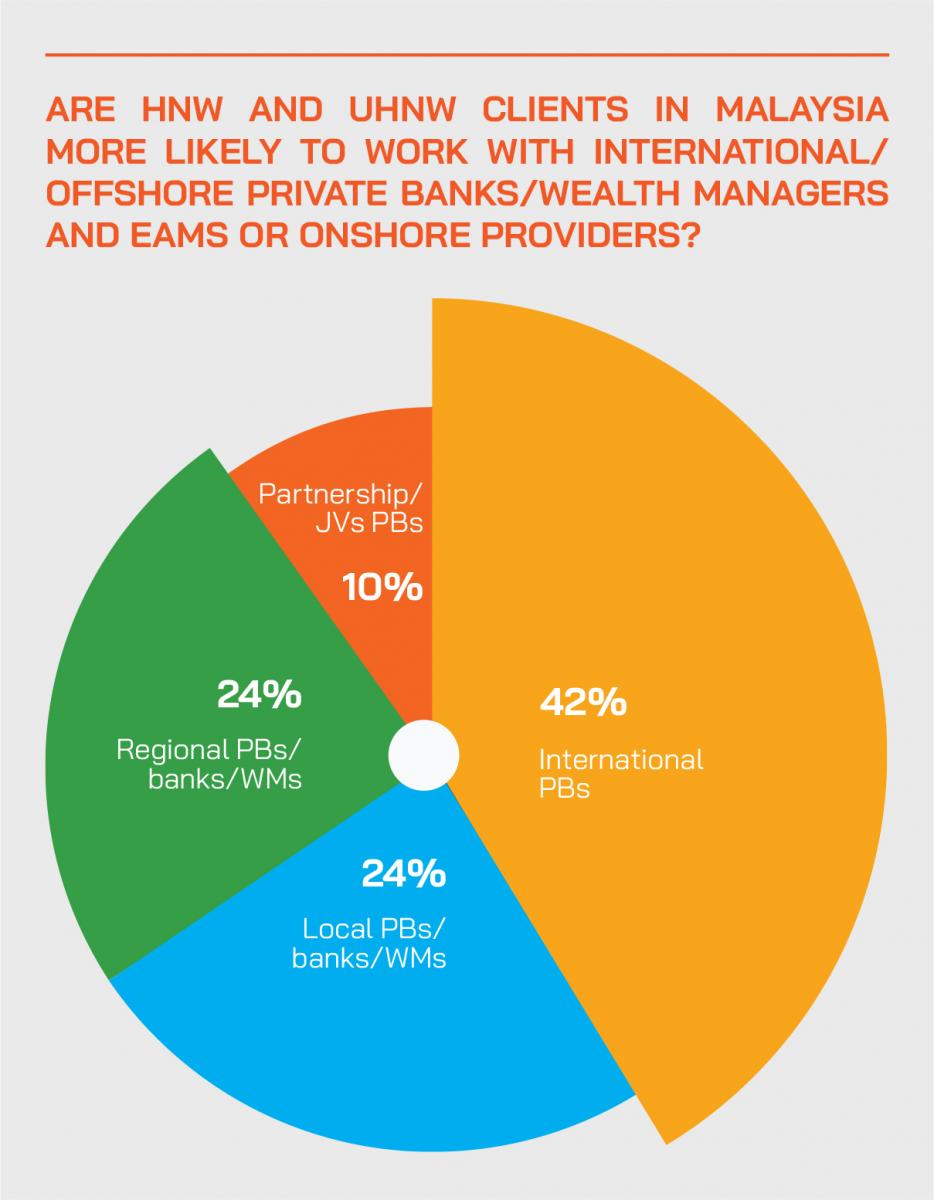

Onshore, offshore or a combination of the two will certainly make up an exclusive banker's client base. The balance for each lender will be different relying on where their clients want to book their assets. Working with offshore customers calls for a somewhat different technique to onshore customers and can consist of the following for the lender: They click to read more might be needed to go across borders to check out clients in their residence nation, even when the monetary establishment they belong to does not have a permanent establishment located there, Potentially take full duty for managing profile for the client if the customer is not a resident, Be multilingual in order to successfully interact with clients as well as construct their customer base worldwide, Know worldwide laws as well as regulations, specifically with concerns to offshore financial investments and tax, Be able to link their customers to the right professionals to help them with various areas from tax via to even more useful support such as helping with home, moving, migration consultants and education consultants, Understand the latest problems impacting international customers and guarantee they can develop services to fulfill their requirements, The bank as well as certain group within will identify the populace of a lender's customer base.

Our Offshore Wealth Management Ideas

Associates to the wider monetary solutions industry in overseas facilities Offshore financial investment is the keeping of cash in a jurisdiction various other than one's country of house. Offshore jurisdictions are utilized to pay less tax in several countries by large as well as small financiers.

The benefit to offshore financial investment is that such procedures are both lawful and less costly than those offered in the financier's countryor "onshore". Areas favored by capitalists for reduced rates of her comment is here tax obligation are called overseas economic centers or (often) tax sanctuaries. Payment of less tax is the driving force behind most 'offshore' task.

Frequently, taxes levied by a financier's house nation are vital to the profitability of any type of given investment - offshore wealth management. Making use of offshore-domiciled unique objective mechanisms (or cars) a capitalist may reduce the quantity of tax payable, permitting the capitalist to achieve greater earnings on the whole. Another reason that 'offshore' financial investment is taken into consideration exceptional to 'onshore' investment is since it is much less managed, as well as the actions of the offshore investment service provider, whether he be a lender, fund manager, trustee or stock-broker, is freer than it can be in a much more regulated setting.

The Ultimate Guide To Offshore Wealth Management

Protecting against currency decline - As an example, Chinese capitalists have actually been spending their financial savings in stable Offshore places to shield their versus the decrease of the renminbi. Offshore investments in poorly regulated tax sanctuaries may bypass assents against countries established to encourage conventions vital to societies (e.Corporations are companies created quickly Produced and, as well as they are heavily taxed on Exhausted operations, they pay no taxes on foreign activitiesInternational As an outcome, more than of 45,000 overseas covering companies and subsidiaries companies are created in Panama each year; Panama has one of the highest possible concentrations of subsidiaries of any kind of country in the globe.